HOW FDR’S CONTROVERSIAL GOLD RECALL DURING THE GREAT DEPRESSION LED TO MAJOR NUMISMATIC RARITIES

By Dustin Johnston

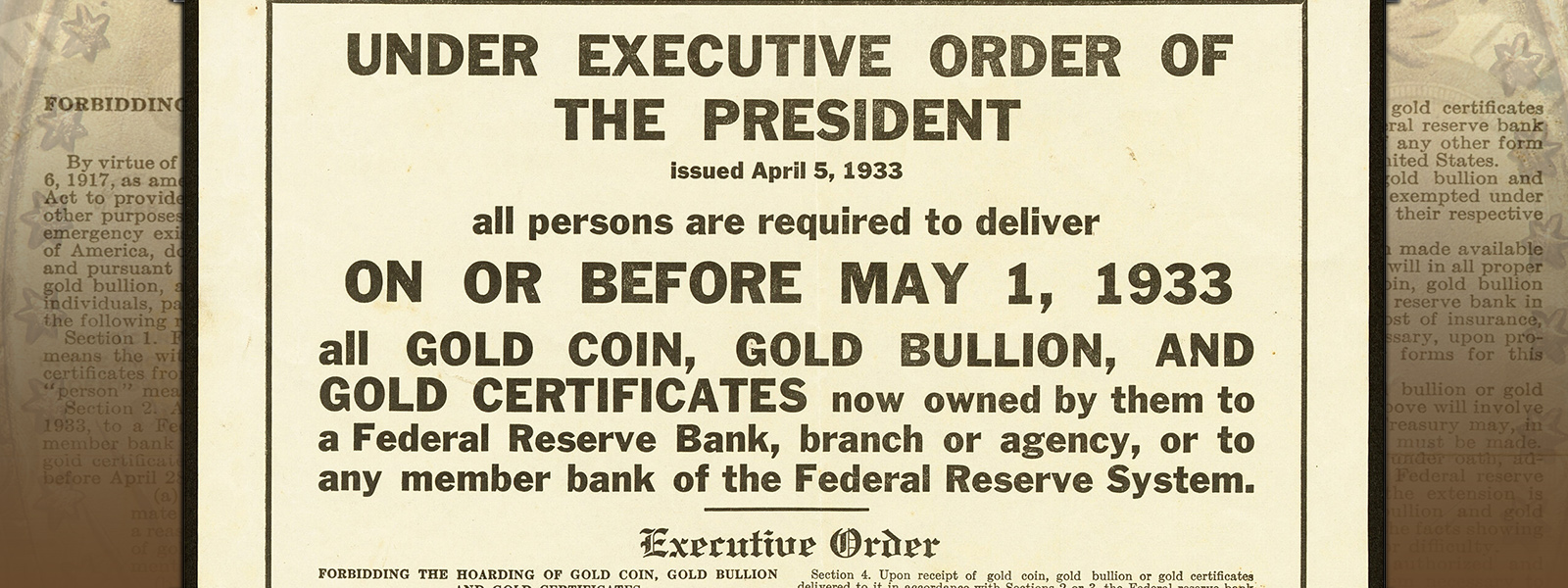

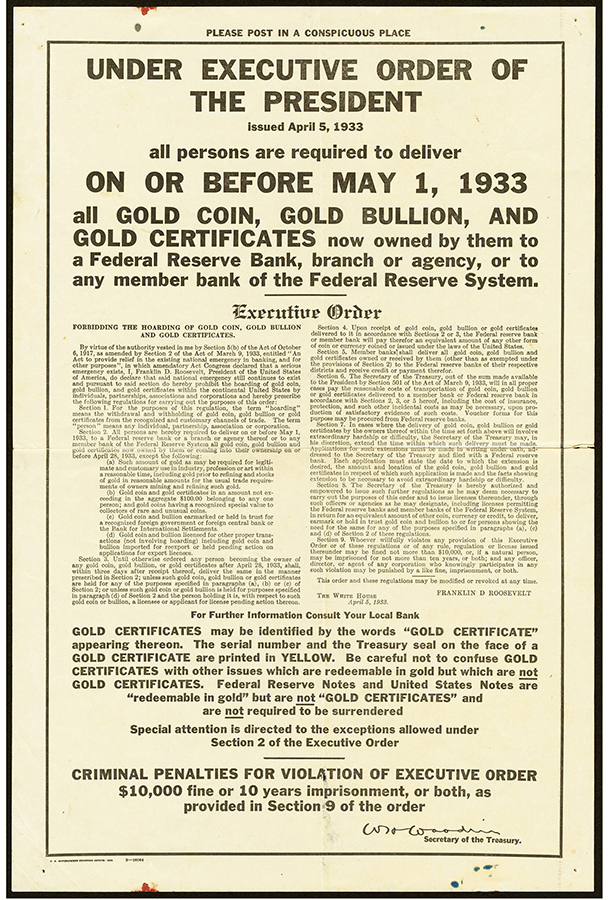

This 1933 government broadsheet announcing the required surrender of gold coins, gold bullion and gold certificates is available in Heritage’s January 10-12 FUN Currency Signature® Auction.

Financial systems are tested and changed in times of war and hardship. One of the largest and most controversial actions taken by any government in times of crisis was Franklin Delano Roosevelt’s Executive Order 6102 on April 5, 1933. It required all persons to deliver all gold coins, gold bullion and gold certificates to the Federal Reserve in exchange for $20.67 per troy ounce. Noncompliance was punishable by a $10,000 fine or 10 years in prison, and there were very few exceptions in the provision.

Many of the changes from the Great Depression are still part of the financial infrastructure of the United States, but none left a greater impact on numismatics than this executive order. U.S. currency at the time was issued predominantly through the Federal Reserve and was backed by gold. The Federal Reserve Act of 1913 required a 40% ratio of gold to the total outstanding circulation. With the newly redeemed gold, the Federal Reserve balance sheet could be expanded. After the redemption deadline, the 1934 Gold Reserve Act changed the statutory gold content of the U.S. Dollar to $35 per troy ounce. Instantly, the Federal Reserve could issue nearly 70% more currency on the revaluation alone.

The executive order allowed for small amounts of gold to be owned for artistic, industrial and professional use, and it also exempted “gold coins having recognized special value to collectors of rare and unusual coins.” While collector coins were protected, the redemption halted gold coin production and opened the door for massive melting of already minted gold coins. In tandem there was destruction of vast numbers of gold certificates redeemed from circulation, while a large stock of newly printed notes already delivered to the Treasury went unissued.

The story of the 1933 $20 Saint-Gaudens coin is the poster-child numismatic rarity created from this act. The entire mintage of 445,500 coins was scheduled for issue just 10 days after the fateful executive order. According to Mint records, all but two were melted (the examples slated for the Smithsonian’s National Numismatic Collection). While the correct number of coins was turned into gold bars, we know some pieces were exchanged with other dated $20 gold coins. Today, just one collectable example is allowed by law to be owned privately. It last sold for $18.9 million in 2021.

FDR’s gold recall helped make rarities out of coins such as this 1927-D Saint-Gaudens Double Eagle, which sold for $4.44 million in an August 2022 Heritage auction.

The mass melting of gold coins also created numismatic rarities out of the 1927-D $20 Saint-Gaudens (about 20 examples known to exist), the 1930-S $20 Saint-Gaudens (an estimated 50 to 75 examples known extant) and the 1932 $20 Saint-Gaudens (75 to 95 believed extant). The majority of these mintages were still in the vaults backing Federal Reserve Notes when the executive order was signed. They were subsequently pulled from the vaults and melted into bar form to ease transport, storage and accounting.

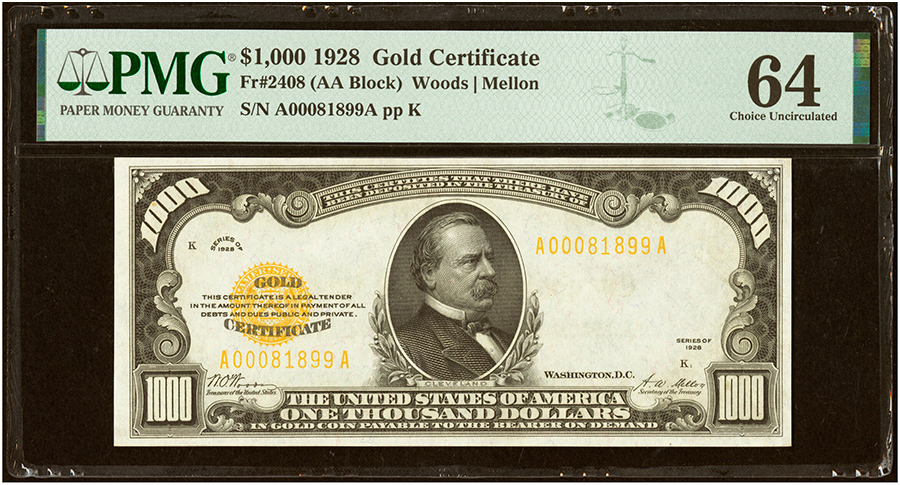

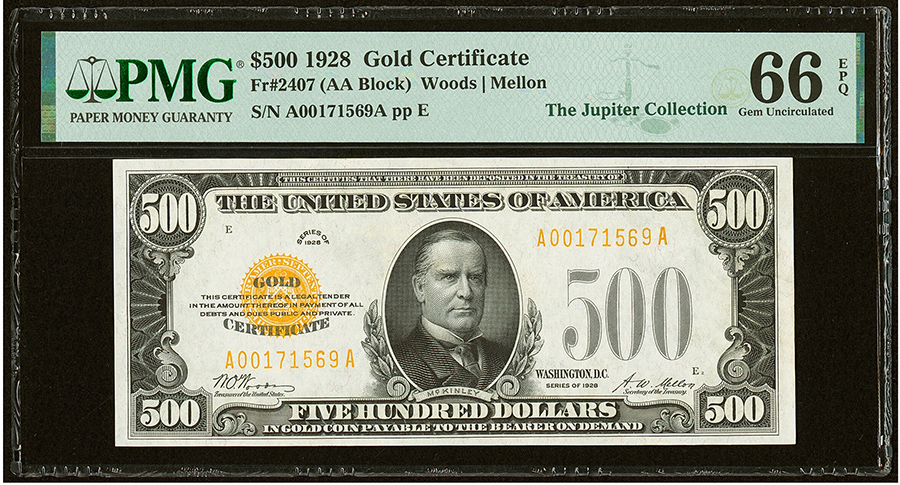

Gold certificates saw heavy redemptions. Unlike gold, they had no intrinsic value, so even those evading the law had no reason to keep the notes; they were valueless. Series 1928 Gold Certificates were in circulation in the denominations of $10, $20, $50, $100 and $1,000.

Like the 1933 $20 Saint-Gaudens, Series 1928A Gold Certificates were printed for the $10 and $20 denominations but never issued. Series 1934 Gold Certificates in denominations of $100, $5,000, $10,000 and $100,000 were designed post-executive order, and a clause prevented their use in general circulation, thus they existed (and were rarely used) in banking channels only. Today, they are all accounted for, with just one serial numbered $100,000 in the Smithsonian, as well as a few Specimen sheets also held in the National Numismatic Collection.

The Fr. 2408 $1,000 1928 Gold Certificate (top) and Fr. 2407 $500 1928 Gold Certificate (below) offered in Heritage’s January 10-12 FUN Currency Signature® Auction hail from one of the finest collections of small size U.S. bank notes.

Heritage’s first installment of the Highland Park Collection in the January 10-12 FUN Currency Signature® Auction includes two of these incredible bank note rarities. Only about 100 to 150 each of the $500 and $1,000 gold certificates are known in collecting circles. They are the two largest-denomination small size gold certificates available to collectors. The Highland Park notes are part of one of the finest offerings of small size U.S. bank notes. Respectively, they’re the single finest and tied for finest graded examples by Paper Money Guarantee.

Unlike the Saint-Gaudens $20s, of which there are many millions of examples of the design type for collectors to choose from outside of the major rarities, this is a “one-year” type, as currency collectors say, which means there are only 100 to 150 examples each of the $500 and $1,000 gold certificates available in total. The January offering is historic for the specialist who wants to round out the numismatic story molded by our nation’s greatest financial crisis, and complemented by an offering of one of the few surviving broadsheets printed to alert the public about the executive action and redemption deadline.

Go here for the full list of lots in Heritage’s January 10-12 FUN Currency Signature® Auction.

DUSTIN JOHNSTON is Vice President of Numismatics at Heritage Auctions. He can be reached at 214.409.1302 or dustin@ha.com.

DUSTIN JOHNSTON is Vice President of Numismatics at Heritage Auctions. He can be reached at 214.409.1302 or dustin@ha.com.