HOW BREAKTHROUGH BIDDING CAN LEAD TO BIG RETURNS IN COLLECTIBLES

By Joe Orlando

Let’s get something straight right out of the gate. No, the title of this article is not an ode to Bobby “Bacala” and perhaps one of the funniest yet most awkward moments on The Sopranos, which celebrated its 25th anniversary this year. Those who remember the scene between a nervous Bobby and a visibly irritated Tony Soprano are probably laughing right about now. Wasn’t that a terrific show?

I digress.

1932 Babe Ruth game-worn New York Yankees World Series ‘Called Shot’ jersey, SGC Superior, photo-matched. Sold for $24,120,000 in an August 2024 Heritage auction.

On the heels of hobby history and after Heritage held the single biggest sports auction ever just weeks ago, which contained numerous record prices in a variety of categories, I felt inspired to write this piece. While I hopefully have many years of collecting ahead of me, I am also old enough to have seen this movie time and time again throughout my collecting lifetime.

What “movie” am I referring to?

Every so often, an extraordinary item comes to market and breaks through an unprecedented price barrier. The type of immediate reaction runs the gamut. A good portion of people act dumbfounded. “Why would someone pay that much?” they exclaim. “The winning bidder must be out of their mind!” the skeptics say.

1954 Hank Aaron game-worn and signed Milwaukee Braves rookie jersey, MEARS A8.5, photo-matched. Sold for $2,100,000 in an August 2024 Heritage auction.

Well, some bidders might appear crazy to most, but they are often crazy like a fox when it comes to knowing when to go for it with what seems like reckless abandon, but it’s not reckless at all in reality. For most of us, it is hard to step up at the moment, knowing that the next bid or the price you might ultimately pay will be more than anyone else has ever spent for that item or one in its category. Seeking that title is counterintuitive to most, so we tend to hesitate.

1911 ‘Shoeless Joe’ Jackson game-used and sidewritten rookie bat, PSA/DNA GU 10. Sold for $2,010,000 in an August 2024 Heritage auction.

The irony is that the hobbyists who embrace that title and can overcome the initial fear are the ones who often benefit the most, both financially and from a collector satisfaction standpoint. First and foremost, it takes the appropriate level of financial wherewithal to create the opportunity in the first place. We need to make that perfectly clear, but it takes more than money. It takes courage, foresight, knowledge and holding power, amongst other things, too.

I have witnessed and experienced countless hobby moments like this. Perhaps the most memorable public example occurred nearly three decades ago when super collector Marshall Fogel paid an unthinkable $121,000 for a PSA Gem Mint 10, 1952 Topps Mickey Mantle. That’s right; to most people, it was absolutely inconceivable at the time, so much so that some hobby figures openly mocked Fogel for his “insane” purchase.

Who’s laughing now?

1920 Walter Johnson game-worn Washington Senators jersey, photo-matched to first game facing Babe Ruth as a Yankee (career victory #299). Sold for $2,010,000 in a May 2024 Heritage auction.

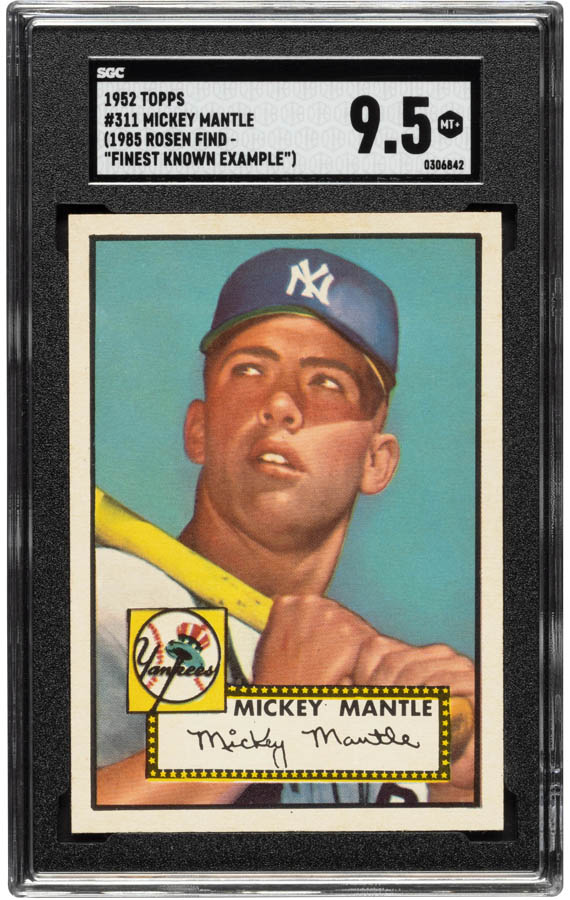

In May of this year, Heritage sold a stunning 1920 Walter Johnson game-worn jersey for $2,010,000. The last time it sold publicly, in 2006, the jersey closed at $352,000. The record-setting SGC Mint+ 9.5, 1952 Topps Mickey Mantle sold for $12.6 million two summers ago and was purchased by the consignor ungraded for $50,000 in 1991, but people forget that figure was a shocking number at the time.

Frequently, a buyer is required to break through one perceived price barrier to eventually reach another one when it comes time to sell.

1952 Topps Mickey Mantle #311 SGC Mint+ 9.5 (1985 Rosen Find). Sold for $12,600,000 in an August 2022 Heritage auction.

I could go on and on with examples like this, and this principle can apply to collectibles at various price points, not just the headline grabbers covered in this editorial. A “barrier” for one collectible might be $10,000, while another could be $20 million. It is relative to its specific category and type. The dynamic is all the same. Someone has to be first.

Without any hesitation, I can tell the readers I have never – not once – ever regretted paying up or tomorrow’s price for an exceptional collectible. Not once. At the time of the purchase, did I have moments of anxiety that occasionally morphed into queasiness? Yes, but the uneasy feeling dissipated, and I never regretted it in the long term. Exceptional collectibles warrant exceptional prices, and they can often provide exceptional personal and monetary returns.

It is a tale as old as time.

I am not sure how many of you do the following, but apparently, I enjoy torturing myself on occasion. For more than three decades, I have kept a substantial archive of auction catalogs. Every once in a while, I will brush away the cobwebs and dust so I can sift through one of them. Yes, in case you are wondering, some of these auctions were held before the internet platform became prevalent. Other catalogs are no longer archived online, so the physical books are all that’s left.

Of course, most auction houses today have robust online archives that collectors can peruse, but the pain is all the same. How many times do you go back in time and ask yourself, “Why didn’t I go for it when I had the chance?” Collectors rarely regret paying top dollar for top-quality items, but they do often regret not making their move when something special becomes available.

The auction catalog time machine can take a collector to a troubling place, offering painful reminders of lost opportunities from the past. None of us have a crystal ball, but as the saying goes, past behavior is often a good indication of future behavior. This is true of people and markets.

Based on the history of our hobby, it is abundantly clear that those who have the ability and appetite to pounce when “beachfront property” springs loose in our world are the collectors who usually have the last laugh.

That, I do know.

JOE ORLANDO is Executive Vice President of Sports at Heritage Auctions. He can be reached at JoeO@HA.com or 214.409.1799.

JOE ORLANDO is Executive Vice President of Sports at Heritage Auctions. He can be reached at JoeO@HA.com or 214.409.1799.