DOWNSIZING BABY-BOOMERS, TAX REFORMS LEADING HOMEOWNERS TO ALTERNATIVE SELLING STRATEGIES

By Rochelle Mortensen

The luxury housing market in many upscale areas around the country is suffering. Traditional high-end hot spots – like Southampton, Boston and Newport Beach, Calif. – are seeing sharp price drops and rising inventory.

LUXURY REAL ESTATE

Industry experts from across the country report a bleak outlook for sellers in 2019. Appraisal company Miller Samuel reports a nearly 20 percent drop in sales in the Hamptons in the first quarter – making it the fifth consecutive quarter to reflect declining sales. Meanwhile, the more commutable Hudson Valley is seeing the market for the highest-end homes stagnate.

“The Westchester market, while popular among commuters, is still seeing large price reductions in the luxury market and soaring inventory,” says Robin Eckhaus of New York real estate brokerage William Ravies Armonk. “I’m advising my clients to pay attention to the news about the market and be realistic in their expectations.”

Similarly, multiple listing services in Boston report a 22.4 percent decline in luxury sales prices compared to last year (for homes priced over $2 million). Even recently strong markets are showing signs of a downturn. Newport Beach saw a 33.3 percent decline in sales over $2 million and first-quarter sales in Miami reported price drops on par with the Hamptons.

There are several possible reasons for the slowdown. Downsizing baby-boomers are increasingly shedding surplus vacation homes, and downsizing their larger primary residences. Added to that is the pressure on the market brought on by 2017 tax reforms, which both lowered mortgage interest deductions and put a cap on state and local tax (SALT) deductions, making owning multiple homes in higher tax states much less appealing.

“Homeowners with several luxury properties are finding it increasingly unappealing to carry that much overhead in housing,” Eckhaus says. “Baby boomers no longer want to coordinate the upkeep of multiple properties, so it’s making more sense for them to reduce the size of their non-income-producing real estate portfolios. Many millennials aren’t in the position to buy such prestigious homes yet, and the much smaller group of Gen Xers aren’t absorbing all of the excess properties.”

TURNING TO AUCTION MODEL

With rising inventory and falling prices, homeowners of luxe properties will need to get creative to sell in a timely manner.

In Dallas, some owners of luxury condominiums are offering to pay association dues, sometimes for a full year, to get buyers in the door. In Los Angeles, sellers are engaging public relations firms to hold over-the-top events on site to entice buyers. Increasingly, sellers are turning to the auction model to sell homes more effectively.

Enlarge

“An auction creates an incentive for buyers to make a decision quickly. They know the house won’t be available the next day, so they have to act if they want the chance to own a particular property,” says Heritage Auctions’ Nate Schar, category director for Luxury Real Estate. “With inventory so high, especially in places like Westchester and the Hamptons, buyers can take their time looking at every home on the market. An auction incentivizes the decision to act where the best opportunity lies.”

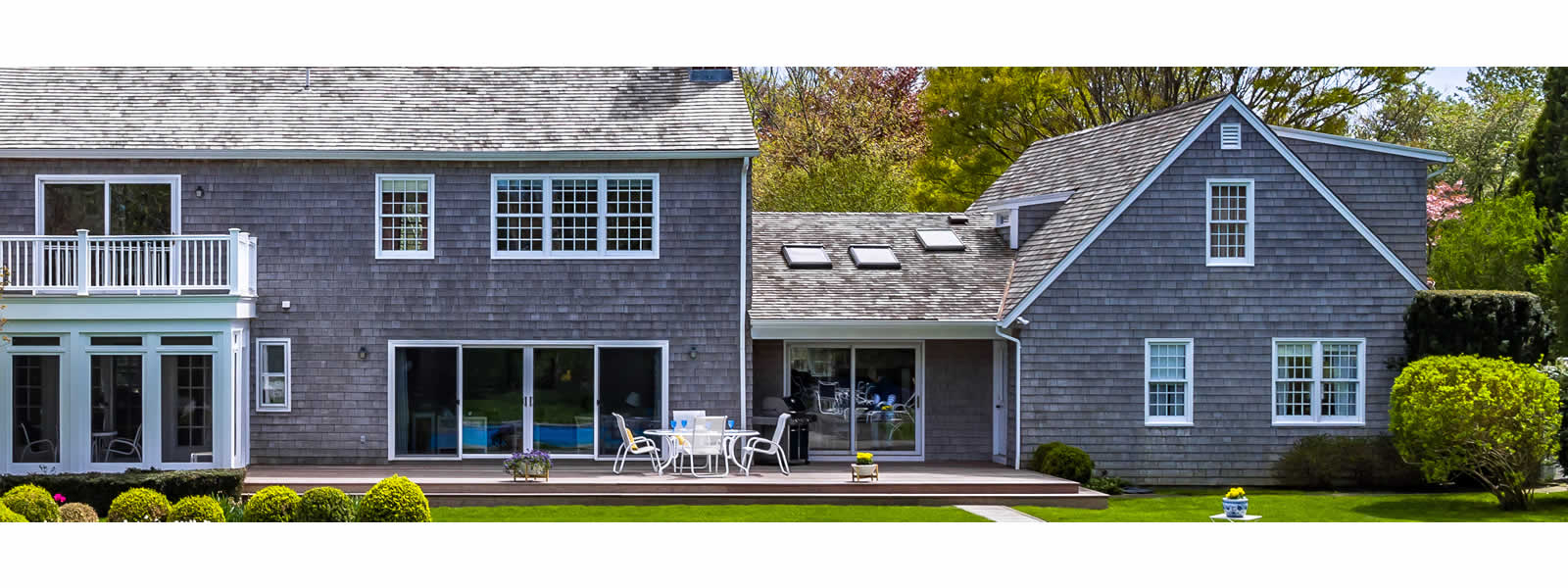

A good example of the success of the auction model is the successful sale Heritage Auctions conducted in East Hampton last summer. The home at 15 Pondview Lane drew a crowd of competing bidders and ultimately realized $4.62 million. Heritage marketed and sold the property within 76 days. Meanwhile, other homes and lots on the same street remain unsold and have seen several price reductions as sellers struggle to find the price the market will bear for attractive, walkable properties close to town and the beach.

“Downward pressure on prices is a good reason for sellers to act quickly and creatively to sell their unneeded properties,” Schar says. “There’s no reason to continue to carry costly properties if they’re no longer providing the enjoyment they once did.”

The overall housing market in the United States is slowing down. The National Association of Realtors reports a decreasing number of sales overall in 2019 compared to last year, and continuing a trend of declining sales from 2018. Increasing inventory levels of existing homes have pushed supply to greater than a six-month supply in five metro areas, including Miami. Additionally, falling prices and longer sales cycles signal a shift towards a buyer’s market in many metropolitan areas across the country. In May, the U.S. Census Bureau released a report that new home sales fell more than expected in April.

“Pride of ownership and ego can sometimes interfere with making logical financial decision,” Schar says. “In an unstable market, it’s best to sell before your neighbors prices bring yours down. If you don’t need to own, don’t wait.”

ROCHELLE MORTENSEN is manager of Heritage Auctions’ Luxury Real Estate (HA.com/LuxuryRealEstate). To learn more about luxury real estate auctions, contact Nate Schar at NateS@HA.com or call 214.409.1457.

ROCHELLE MORTENSEN is manager of Heritage Auctions’ Luxury Real Estate (HA.com/LuxuryRealEstate). To learn more about luxury real estate auctions, contact Nate Schar at NateS@HA.com or call 214.409.1457.

This article appears in the Fall 2019 edition of The Intelligent Collector magazine. Click here to subscribe to the print edition.