WHETHER YOU COLLECT ART, ANTIQUES OR COMIC BOOKS, THE FATE OF YOUR ASSEMBLAGE IS SOMETHING TO THINK ABOUT SOONER RATHER THAN LATER

This Chinese bronze Guanyin from the Estate of Dr. Cornelius Osgood and Soo Sui-ling Osgood realized $23,750 in a September 2022 Heritage auction.

By James Halperin and Greg Rohan

A collector spends countless hours carefully and lovingly amassing a collection, often having fought for individual pieces at auctions, made great discoveries in unlikely locales, overpaid for that much needed example and watched as the value of that collection grew over the years. Selling a collection during one’s lifetime can provide enjoyment, accolades and the benefit of reaping the financial rewards. That financial realization can be used for donations, gifts or to pursue building a better collection – or beginning in a whole new collecting field. As collectors ourselves, we understand the fun of collecting and the pleasure to be found in the thrill of the hunt. We see many collectors who sell an entire collection multiple times during their lives and then branch into wildly fluctuating directions of interest – or choose to concentrate their collecting on higher-quality examples in their field.

First, let’s consider some of the logistical and practical reasons for selling a collection during one’s lifetime rather than donating, gifting or leaving the collection in your estate.

Start planning for your collection early if you want it preserved or if you want your heirs to receive the highest value for it, even if you anticipate many more decades of collecting. Research and stay informed regarding the current market for your collecting category to know when it might be the best time to sell or when it appears to be more of a buyer’s market.

A collector may have established relationships with a particular auction house or dealer – or have strong opinions as to what venue they would prefer to see their collection sold through. Being able to make the decision of sale venue and negotiate the best possible sale terms should be the responsibility and concern of the collector themselves, not left as a burden to their heirs. All too often we see situations where inherited collections or disinterested families sell in inadequate local venues or to unscrupulous dealers and receive only a small percentage of the true value. Below is an example of how much can go wrong when there is a lack of careful planning during a collector’s lifetime:

Heritage’s Trusts & Estates Department was approached by an heir who had inherited half of his father’s comic book collection and wanted to know what the sale potential and market value was for his inheritance. The comics turned out to be wonderful examples of some rare and excellent-condition Golden and Silver Age comics from the 1940s through 1960s. Heritage marketed the collection extensively and ended up selling the comics at auction for more than $800,000. When we asked the heir about the other half of the collection that had been left to his sibling, he told us the all-too-familiar story of the other half having been sold locally for less than $15,000. His sibling’s disinterest and lack of knowledge about the value potential for the collection resulted in a significant loss of inheritance – surely not their father’s intention.

Will codicils and directives may be written to instruct your heirs how you would prefer your collection to be dispersed or sold as part of your estate. Those directives are not always fully enforceable or followed by your beneficiaries. By overseeing the sale themselves, collectors know that they have done best for their collections and are able to receive the recognition and value they deserve.

As part of an estate gift of collector Mary Anne Sammons Cree, this David Webb jewelry suite sold for $47,500 in a September 2022 Heritage auction. Proceeds from the sale benefited Communities Foundation of Texas.

To Gift or Not To Gift

If a collection is valued over the current lifetime gift tax or estate tax exemption threshold ($12.92 million per individual in 2023), or the combined assets of an individual exceed that amount, then it is important to consider the implications of paying estate tax upon your passing versus possible gift tax during your lifetime. There are very practical tax benefits of selling high-value items or collections during your lifetime, rather than just allowing your estate and heirs to deal with the distribution, sale and taxes.

Federal law provides that the threshold for lifetime gifts and the estate tax exemption for transfer at death are the same amount, but the law allows for increases considering inflation. For a death or gift in 2023, the exemption amount is $12.92 million per individual. Gift tax rates start at 18% and can reach up to 40% on certain gift amounts. The tax responsibility typically lies with the donor, not the individual receiving the gift. There are practical benefits to consulting your legal and tax advisor to consider planning around lifetime or estate gifts of your collection.

Another benefit of lifetime gifting is that by making the gift of a tangible item, you are establishing a new cost basis as of the date of the gift for the fair market value. The recipient, whether a trust or individual, would then benefit from less capital gains taxes when they choose to sell.

There are also benefits with planning to make annual exclusion gifts in any one tax year. The 2023 annual gift exclusion amount is $17,000. An individual can make as many annual gifts to as many people (not just family) as they wish during a tax year. Spouses can make what are called split gifts in any tax year under the same circumstances, thus doubling the benefit of the gift tax annual exclusion limit. Always consult with your tax advisor to determine what the regulations are for filing gift tax returns and in what circumstances filing is necessary.

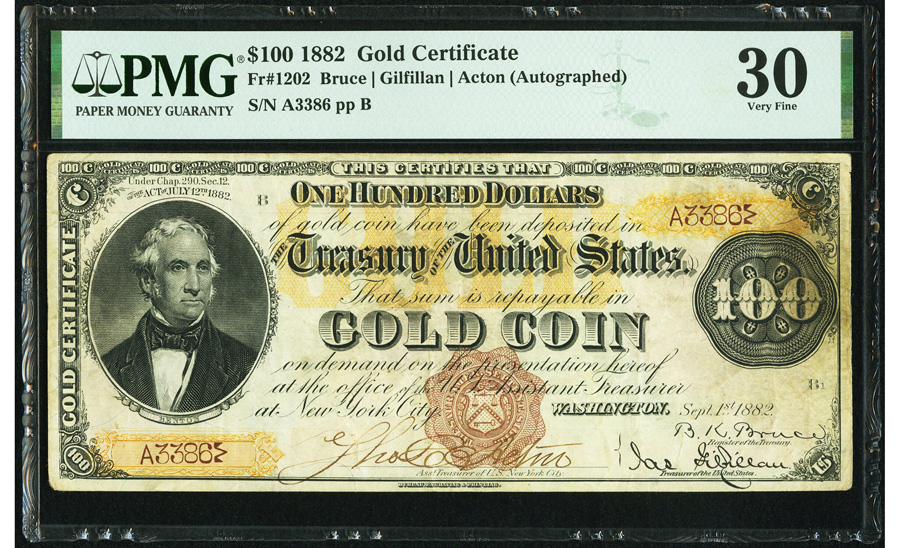

This unique hand-signed triple-signature 1882 $100 Gold Certificate from the Allan H. Goldman Collection sold for $750,000 in an October 2022 Heritage auction.

Another important tax consideration for lifetime giving is how it affects the tax cost basis of the gifted item. For tax purposes, the cost basis is the original purchase price of an asset. Generally, a taxpayer who acquires property by gift takes a basis in the property equal to the donor’s adjusted basis in the property at the time of the gift. This differs from bequests and gifts upon death. For inheritances, the basis is the fair market value on the date of the decedent’s death or six months afterward if the executor elects the alternative valuation date. The recipient’s basis for inherited property is stepped up (or stepped down) from the decedent’s cost to the asset’s fair market value at the decedent’s date of death. This is referred to as a carryover basis and is often used for lifetime giving. The basis remains the same as when the giver held the asset, but the basis may be adjusted to account for any gift taxes that were paid at the time of the gift. To figure out the basis of the property received as a gift, you must know the donor’s adjusted basis just before the donor made the gift, the fair market value of the property at the time the donor made the gift, and the amount of any gift tax paid on the gift. The considerations involved in making lifetime gifts or gifts at death require careful planning and analysis with family members and estate and tax advisors to ensure your wishes and expectations are met for your collection.

Donation Considerations

The notion of preserving one’s legacy for future generations in the public collections of museums, libraries and archives is every collector’s dream. Unfortunately, the reality of what might happen to your beloved collection upon donation may not reflect your intent and expectations.

Museums and nonprofits may not need or desire your collection. For example: In order for a collector to receive the optimum tax benefits of a donation, the receiving entity must have “related and like use” of the items. A collector’s perception of the importance of works of art or collectibles may not be shared by current or future curators. The museum’s mission and direction may change over the years so that your donation may find its way into a storage cabinet or warehouse locker.

‘Blue and Gold’ by Porfirio Salinas. The oil on canvas, property from a Texas Estate, realized $42,500 in an October 2022 Heritage auction.

A museum’s permanent collection is not always permanent, and museums are a consistent source of material in the auction market. Whether sold to fund future acquisitions, assist with the wider capital campaigns or even provide operating funds, institutions often have a more pressing need for money than objects. In many cases, it is preferable for the institution to receive a cash donation over an individual’s collection.

In addition, donating the cash from a sale of an item doesn’t often generate the same concern for an IRS audit as does a tangible gift, which requires an appraisal. An auction sale almost always complies with the very definition of fair market value and determines the charitable donation valuation for tax purposes. Past abuses, including outright fraud and tax evasion, have led to very strict requirements for acceptable charitable donation appraisals.

Many institutions do not accept donations that are bound by stipulations of permanent holding or display. Only a very small percentage of donated items actually get displayed. Furthermore, when a particular painting or artifact becomes especially valuable in the market, the decision may be made to sell it in order to obtain the monetary funds to support the institution’s mission and endeavors.

This circa 1920 Daum vase from the Estate of Myra Janco Daniels realized $14,375 in a January 2023 Heritage auction.

If the institution is requesting the gift or donation from you, the object probably has a much better chance of regular exhibition, although there is never a long-term guarantee. If the donated item is regularly displayed, it usually will have acknowledgement of the donation’s source on the wall plaque and in any published literature. There are other methods in gifting a tangible asset that can provide the same recognition but under different circumstances. For example, a collector may consider loaning a piece of art to an institution or a fractional gift of ownership. Including art or collectibles as part of museum exhibitions adds to the provenance or history of a piece, which will make it that much more desirable and valuable to the market.

Auctioning a collection in its entirety can increase the value of the lesser pieces in the collection by association with the most sought-after pieces. By establishing a collection identity, the provenance and pedigree of that collection will carry forward with the items forevermore to add recognition and appreciation both for the collector and the collection. Particularly in the collectibles categories such as coins and comic books, the provenance and pedigree are key to securing an item’s desirability and value in the market.

The idea of parting with a beloved collection may seem initially unwelcomed and unthinkable, but the fact is that the “letting go” of a collection is an inevitable part of a collector’s life – the question is how and when. With proper planning by a team of professional advisors, making wise decisions to oversee and control the sale, gift or donation can lead to greater after-tax monetary reward, family harmony and fulfilling charitable objectives.

This article is excerpted from The Collector’s Handbook: Tax Planning, Strategy and Estate Advice for Collectors and Their Heirs.

JAMES HALPERIN is Co-Chairman and Co-Founder of Heritage Auctions.

JAMES HALPERIN is Co-Chairman and Co-Founder of Heritage Auctions. GREG ROHAN is President of Heritage Auctions.

GREG ROHAN is President of Heritage Auctions.