LESSER-KNOWN TAX PLANNING STRATEGY CAN BE EFFECTIVE, ESPECIALLY WHEN USED BY COLLECTORS

By Michael Schwartz, Ron Deutsch, Paul Hoerrner Jr. and Michael Tanney

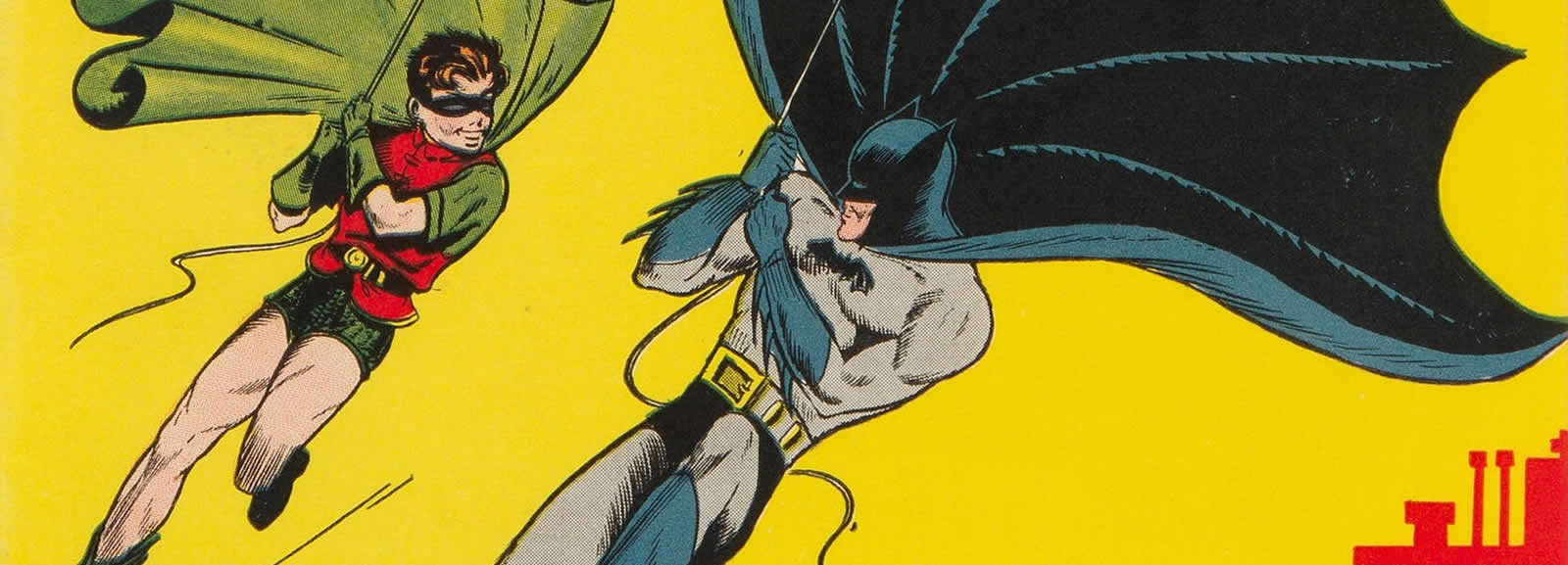

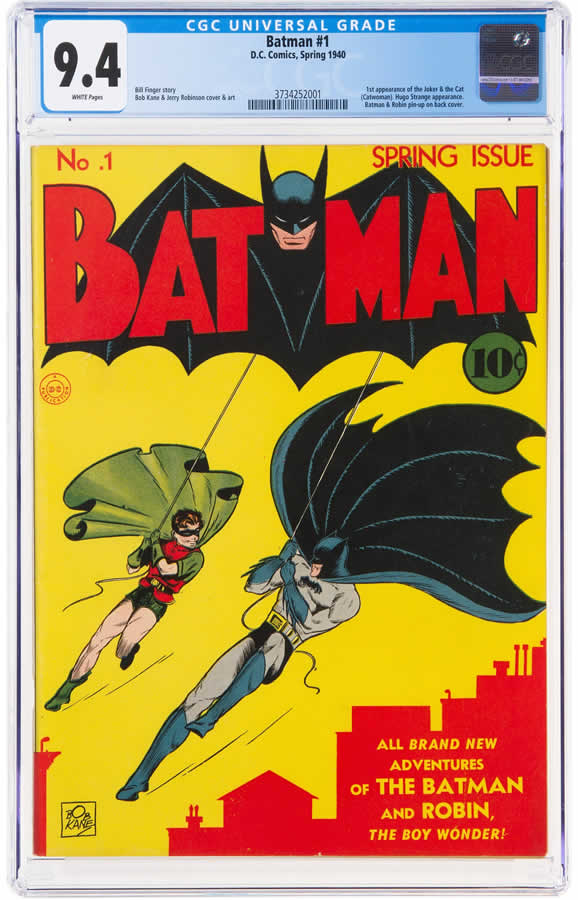

Holy Batmania! That is probably what Robin, the Boy Wonder, would say if he heard the recent selling price for an original Batman comic book – $2.22 million. Considering it sold in 1940 for 10 cents, it sounds more like a hoax by the Joker, or a puzzle from the Riddler, but this was not just any comic book.

It was the issue where creators Bill Finger and Bob Kane gave Bruce Wayne, the Caped Crusader, the Dark Knight – Batman – his own comic book (after his 1939 debut in Detective Comics #27). Today, eight decades later, many collectors and enthusiasts consider it the most desirable – and valuable – comic book in existence. According to the New York Post, in January 2021, Heritage Auctions propelled the Batman seller into an elite $2 Million Club, which started in 2011 when actor Nicolas Cage sold a copy of Action Comics #1 for over $2.16 million. In 2014, a copy of the first Superman comic sold on eBay for a whopping $3.2 million, according to Hypebeast. These prices are truly mindboggling, considering the intrinsic values are nothing but cheap paper and a little ink. It seems that no matter what price was paid, big profits were made. That is the good news. However, to keep Commissioner Gordon on the payroll, Uncle Sam’s going to want his cut, so you should understand how collectibles are ultimately taxed.

Internal Revenue Code (IRC) 408(m) outlines what the IRS considers collectibles – things like art, comic books, trading cards, antiques, stamps, coins, metals or gems and even alcoholic beverages such as bottles of wine – as alternative investments. Generally, they are taxed with a maximum capital gains rate of 28%. That is the highest rate you will pay, but it is considerably higher than the 15% tax rate most taxpayers face with other capital assets. However, the 28% rate is still quite advantageous for higher tax brackets compared to taxes on ordinary income for those in high tax states and that is why collectibles can make attractive long-term investments. If your adjusted gross income (AGI) is higher than $250,000 in the year of the sale, there will be an additional 3.8% net investment income tax (NIIT) making the combined tax rate 31.8% at the top tier.

When selling a collectible, the cost basis is calculated in the usual way where you will add the original cost, plus any fees or commissions paid at the time of acquisition. You can then also include any restoration and maintenance fees associated with managing the investment. If you inherited the collectible, you would get a step-up in basis, which is the fair market value of the item at the time of inheritance. The value should be based on a qualified appraisal which considers recent sales of comparable assets. However, keep in mind that comparables are subjective and do not always accurately account for the condition, so you could underestimate – or overestimate – its value. Once the cost basis is established and subtracted from the sales price, that gives you the capital gain. The next question is what can be done about the expected high tax bill?

TAX-FIGHTER’S TOOL: STRUCTURED SALES

While there are different options in addressing high tax bills, a lesser-known tax planning strategy that can be effective, especially when used by collectors, is a structured sale, which is a variation of an installment sale. An installment sale is an alternative financing arrangement where the seller allows a buyer to make specified periodic payments on a purchase over a given contractually defined period. The strategy, codified in IRC Section 453, entitles a seller to defer the gain and report the payments as they are received rather than having to report the entire gain in the year of sale. In a traditional installment sale, the longer the installment period, the greater the risk of default.

That is where a structured sale can come to the rescue. After the sale, the buyer assigns his obligation to an assignment company and the assignment company receives the net proceeds of the sale, thereby allowing the seller to avoid constructive receipt. The assignment company guarantees the buyer’s payments enhancing the security of the transaction. To assure the repayment, the net sales proceeds or a portion thereof can be invested into an annuity product and/or certain private placement variable products which can provide further investment flexibility, and which may further enhance the tax benefits.

Enlarge

The recent Batman comic noted by the New York Post was sold by the son of a collector who inherited the comic from his father. The original purchase price in 1979 was $3,000. Let’s assume the seller was a New York resident and sold the comic for $2 million using a structured sale. In doing so, the seller would have deferred approximately $635,000. The capital gain in the example is $1,997,000, which would have been taxed at 28% ($559,160) plus state capital gains of 8.82% ($176,135) and an additional 3.8% in NIIT ($75,886).

Think of a structured sale as a way of telling Uncle Sam, “I’m sending your check – but not for a long time.” In the example above, $635,000 in taxes may be a lot to pay today, but if you can split it up without penalties over 10 years or more, it can reduce the tax burden paid each year, it can allow more of the net sales proceeds to be reinvested pre-tax and with inflation may allow you to pay the taxes later with discounted dollars. With more advanced planning, you can alter the timing of future gains and losses so you can manage your taxes to take effect in years that are most advantageous to you.

Whether you are selling a rare edition of a Batman comic, valuable trading cards or other highly appreciated art, combining a structured sale with the sale through a qualified auction house like Heritage Auctions may be the ultimate Dynamic Duo. Consider speaking with a qualified investment advisor and tax specialist regarding your particular situation. Investing in risky collectibles but giving up your profits in taxes is a strategy even the Joker would not find funny.

MICHAEL SCHWARTZ, CFP®, AEP®; RON DEUTSCH, CFA®, MBA; PAUL HOERRNER JR., CFP® and MICHAEL TANNEY are investment advisors at Magnus Financial Group LLC (MagnusFinancial.com).

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. It is only intended to provide education about the financial industry.

This article appears in the May 2021 digital edition of The Intelligent Collector magazine.