GOLD AND PLATINUM TIMEPIECES ARE HAVING THEIR MOMENT IN THE SUN

By Josh Hendizadeh

For over a decade, the luxury watch market has been dominated by stainless steel. Collectors and speculators alike drove demand for iconic references such as the Patek Philippe 5711A, Audemars Piguet Royal Oak and Rolex Daytona, sending prices soaring to unprecedented heights. At the peak of the frenzy, stainless steel timepieces were trading for two to three times their retail price, while their precious metal counterparts – crafted in gold or platinum – sat ignored in showcases or changed hands for less than the value of their metal content. This dichotomy left many scratching their heads. Why would someone pay upwards of $100,000 for a stainless steel 5711A when a gold 5711G or 5711J could be had for significantly less? While hype and scarcity fueled the demand, the disconnect in value made little rational sense – until recently.

Audemars Piguet Quantième Perpétuel Ref. 5548 yellow gold wristwatch. Available in Heritage’s Watches & Fine Timepieces Signature® Auction on June 3, 2025.

Since late 2021, the watch market has undergone a healthy correction, particularly in the stainless steel segment. Prices have cooled across many steel references, bringing a dose of sobriety to what had become an overheated landscape. At the same time, precious metal watches have shown surprising resilience, maintaining their value – or even appreciating modestly – in contrast to their steel siblings.

So what changed?

For one, buyers have become more educated. The once-blind chase for “grail” watches has evolved into a more considered approach, with collectors seeking not only design and brand equity but also intrinsic value. In that context, watches made of gold or platinum begin to look far more compelling.

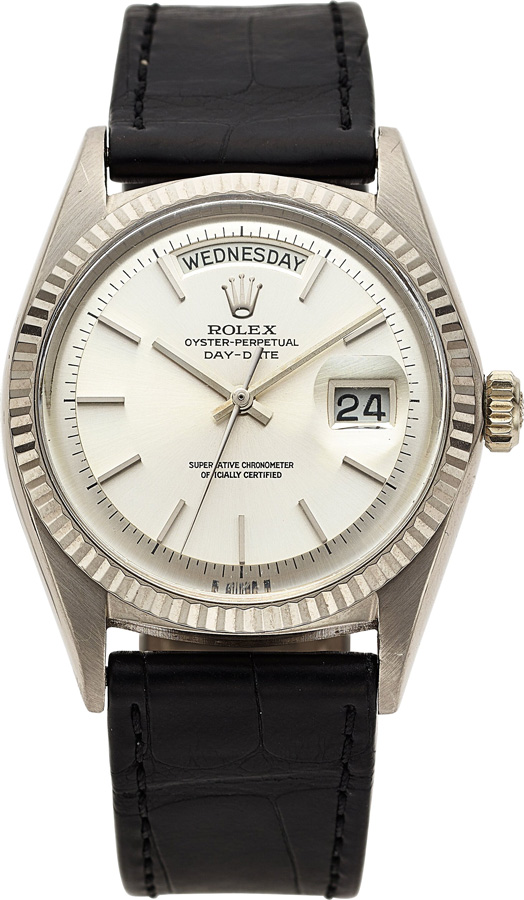

Rolex white gold Day-Date Ref. 1803/9, circa 1967. Available in Heritage’s Watches & Fine Timepieces Signature® Auction on June 3, 2025.

The price of gold, too, has played its role. With bullion prices regularly breaking records, buyers are increasingly aware that precious metal watches carry an inherent floor in value that steel simply cannot match. While watch prices aren’t directly tied to metal spot prices, they do carry a psychological weight. If you’re paying six figures for a timepiece, many buyers now want it to reflect more than just rarity or brand prestige; they want tangible value.

Moreover, the cultural tide is shifting. Stainless steel watches, once symbols of understated luxury, have become almost too ubiquitous. The exclusivity they once promised has been diluted by mass desirability and speculation. In contrast, gold watches – once considered flashy or old-fashioned – are being reappraised by a new generation of collectors. There’s a growing appreciation for their weight, luster and craftsmanship. Vintage precious metal watches in particular are enjoying a renaissance, seen not only as beautiful objects but as enduring stores of value.

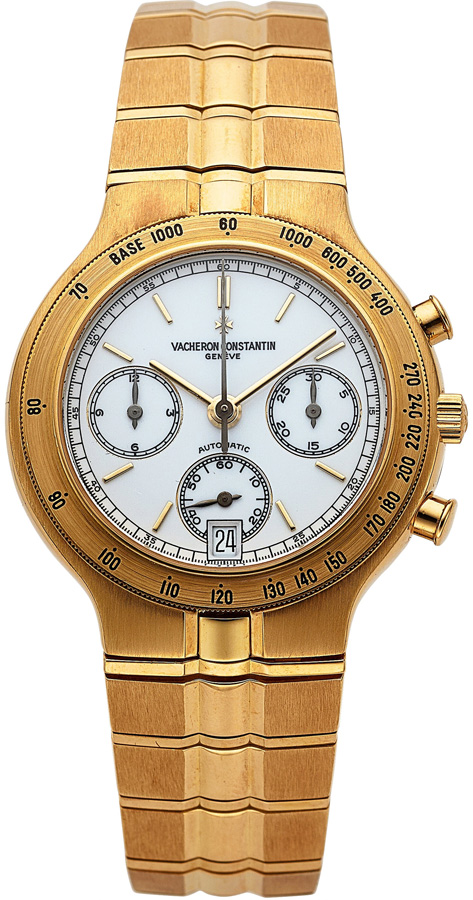

Vacheron Constantin Phidias Ref. 49001/967J-3 yellow gold wristwatch. Available in Heritage’s Watches & Fine Timepieces Signature® Auction on June 3, 2025.

Market data reflects this trend. Auction results and secondary market sales over the past two years show a consistent narrowing of the gap between stainless steel and precious metal variants of the same model. In some cases, the gold versions are now commanding premiums over their steel counterparts – a reversal that would have been unthinkable just a few years ago. There’s also an element of maturity in the collecting community. As tastes evolve, the emphasis is less on what’s trending and more on what stands the test of time – both stylistically and materially.

Steel will always have its place, particularly for its practicality and versatility, but the pendulum is clearly swinging back toward the enduring appeal of gold and platinum. Of course, this isn’t to say that stainless steel watches are no longer desirable. They remain foundational pieces in many collections and will continue to hold significance, especially in tool or sports categories. But the days of steel commanding irrational premiums may be behind us – at least for now.

Patek Philippe Ref. 2552J 18k gold ‘Disco-Volante’ Calatrava. Available in Heritage’s Watches & Fine Timepieces Signature® Auction on June 3, 2025.

In a more rationalized market, where hype takes a back seat to value and substance, precious metal watches offer a compelling proposition. They bridge the gap between horological artistry and tangible investment. For collectors looking to build a long-term portfolio of meaningful pieces, that’s a combination that’s hard to ignore. The rebalancing of the watch market, then, is not just a correction; it’s a recalibration. It signals a broader shift in how value is perceived, how rarity is assessed and how collectors prioritize their acquisitions. Stainless steel had its moment in the sun, but gold is quietly, confidently reclaiming its place on the wrist – and in the hearts of collectors around the world.

Cartier Panthère XL yellow gold wristwatch. Available in Heritage’s Watches & Fine Timepieces Signature® Auction on June 3, 2025.

A quick look at Heritage’s upcoming Watches & Fine Timepieces Signature® Auction, which closes June 3, 2025, further illustrates this trend. Gold timepieces from prestigious brands – like the Audemars Piguet Quantième Perpétuel Ref. 5548, the Patek Philippe 2552J “Disco Volante” and a white gold Rolex Day-Date Ref. 1803/9 – showcase timeless design and high-end complication, often at prices well below what their stainless steel counterparts would fetch during the market peak. Even stylish gold models from Cartier and Vacheron Constantin, such as the Panthère XL, Panthère Vendôme and Phidias Ref. 49001/967J-3, offer an accessible entry point into precious metal collecting. These watches combine design heritage, craftsmanship and intrinsic material value, making them not only beautiful to wear but also smart acquisitions in an evolving market.

JOSH HENDIZADEH is Consignment Director of Watches & Fine Timepieces at Heritage Auctions. He can be reached at JoshH@HA.com or 310.492.8610.

JOSH HENDIZADEH is Consignment Director of Watches & Fine Timepieces at Heritage Auctions. He can be reached at JoshH@HA.com or 310.492.8610.