STEVEN DUCKOR HELPED LAUNCH INDEPENDENT GRADING, ASSEMBLED SOME OF THE FINEST COLLECTIONS EVER SEEN – AND DRAMATICALLY CHANGED THE HOBBY FOREVER

By Beth Deisher ● Portrait by Axel Koester

What is the secret to becoming a successful and savvy collector? Dr. Steven L. Duckor, legendary in coin collecting circles, doesn’t think of his personal mantra – buy the very best, stretch to buy it and hold on to it – as a secret. That’s because he willingly shares it. But he does credit his guiding philosophy as having been the key to his becoming an accomplished and highly successful coin collector.

In the past four decades, Duckor has formed finest-known collections in at least half a dozen series. His Barber half dollar collection – selected to Professional Coin Grading Service’s Hall of Fame in 2003 and sold in 2010 – is widely acclaimed as the all-time finest collection of circulation strike Barber halves ever assembled. And his collections of Saint-Gaudens double eagles and $1 gold coins have equally dazzled the collecting world.

“Collect rare and the best quality,” he advises. “If it doesn’t come gem, other than the few $1 gold coins that are the finest known, I won’t buy it. I’m looking for the very best. Remember my mantra: Buy the very best, stretch to buy it. It means if you can’t afford to buy it, buy it anyway.”

Notable Sale

1926-D Saint-Gaudens Double Eagle

MS66+ PCGS Secure. CAC.

The finest-known example of this issue,

part of the Dr. and Mrs. Steven L. Duckor Collection of Saint-Gaudens

double eagles sold at Heritage’s January 2012 FUN Auction.

Price realized: $402,500

Legendary collector John Pittman, Duckor points out, took a second mortgage out on his home to acquire coins at the 1954 sale of the King Farouk collection. “I’ve done that actually. I’ve taken a second out on my house, borrowed money from my brother 20 years ago to buy coins. It’s worth it,” Duckor says, “if you know what you are doing.”

Starting With Silver Dollars

A native of Indiana, Duckor began collecting coins shortly after his family moved to Miami Beach, Fla., when he was 10 years old. The young Steven collected by series and obtained most of his coins by sorting through change from his father’s business. He was 11 when he bought for $8 his first coin – a 1914-D Lincoln cent in “very good” condition. His father thought it was a lot of money for a penny.

“You’ve got to be kidding!” Duckor recalls his dad saying.

Nevertheless, his father (who was not a collector) trusted his son’s knowledge, was supportive and encouraged his pursuits. “In 1960,” Duckor says, “my father took me to the local bank in Florida. They let me go through all their rolls of silver dollars. My dad said, ‘You can have only one of each date.’ So that’s how I started in silver dollars.”

In his early collecting years, Duckor followed the more traditional path of collecting coins by date and mint mark, filling in albums. But his approach to collecting changed dramatically in the early 1970s. “Really, I didn’t seriously start collecting until I graduated from medical school in 1971 and came to California,” Duckor says.

Shortly after beginning his internship at the University of Southern California Medical Center in Los Angeles, he met a coin dealer who was collecting gem coins. “Gem” is not a grade or description of a coin’s state of preservation. Rather, it is a term that refers to the top tier of grades, generally Mint State or Proof 67 to 70. In some early series, gem also encompasses the 65 and 66 numeric levels because so few are known to have survived at those grades or beyond.

Greatly influenced by the coin dealer, Duckor began collecting circulation-strike gem Buffalo nickels, Standing Liberty quarters, Walking Liberty half dollars and Morgan dollars. By 1976, he turned his attention to gem 20th century gold coins, primarily quarter eagles, half eagles and double eagles. “That was when gold was about $105 an ounce,” he notes.

It was also a time when coins were bought and sold in small, brown envelopes – before independent third-party grading and encapsulation. He made it a priority to become knowledgeable by reading reference books about the series he was collecting, viewing coin lots in order to understand grading, studying auction catalogs and reading stories in Coin World about collections coming to market.

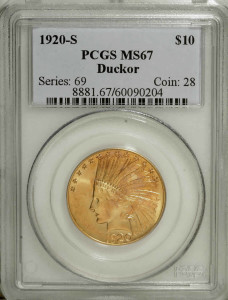

Notable Sale

1920-S Saint-Gaudens Double Eagle MS66 PCGS Secure. CAC.

This important gold piece, tied for the finest certified of

its issue, was offered in the Dr. Steven L. Duckor

Collection of Saint-Gaudens Double Eagles by

Heritage Auctions in January 2012.

Price realized: $575,000

The top coin he purchased between 1976 and 1981 was a 1920-S Indian Head $10 eagle at a Stack’s sale in June 1979. “It was in gem condition, the finest known, and I paid $80,000 for the coin. I can tell you that in 2007, I sold it at Central States in a Heritage auction for $1.725 million. Unbelievable!” he admits.

Duckor cites the gem 1920-S $10 gold coin as confirmation of his decision to concentrate on gem coins.

A Pivotal Partnership

When he learned the Louis E. Eliasberg Sr. Collection of U.S. Gold Coins was to be auctioned in October 1982, Duckor sought out gold specialist David Akers. They first met over breakfast at New York’s Hyatt Hotel on Oct. 27, the morning of the first day of the sale. During the conversation, Akers revealed he had been the under-bidder at the June 1979 sale at which Duckor had purchased the gem Brilliant Uncirculated 1920-S eagle (later graded by PCGS MS-67+). “So we immediately had camaraderie.”

Duckor asked Akers if he would represent him at the Eliasberg sale and together they set up basic criteria.

At the time, Duckor was focused on Saint-Gaudens $20 double eagles. “That night, we bought several key coins from the Eliasberg sale: a superb gem 1908 With Motto that later graded PCGS MS-67, a superb gem 1909-D that later graded PCGS MS-67, a 1920-S graded as choice BU that later became PCGS MS-66, a 1921 graded About Uncirculated 53 that later became PCGS MS-65, and a 1931 graded choice BU that became a PCGS MS-66. So you can tell we bought some great coins.”

Meeting Akers was pivotal. “He became my mentor for 30 years, until his death [in 2012]. He was a great friend, somebody I talked to all the time about politics, the world, the economy, as well as coins. Through David, I redid my whole gold collection over a 25-year period.”

Duckor believes Akers was one of the top numismatists of the 20th century. He credits Akers with teaching him how to discern the difference in quality among coins – an ability many observers say distinguishes Duckor from most other advanced collectors living today.

“I learned that ability from David,” Duckor says. “… He taught me to pick out the gems, the superb coins.” Duckor adds that later the opportunity to compare third-party graded coins also helped because he could see the difference between, for example, a MS-64 versus a MS-66, bolstering his confidence in his ability to delineate quality.

“David had an incredible memory,” Duckor says. “He remembered every coin he had ever seen. He could tell you details or he could go to the auction catalog that he kept details on about the coins and what he thought of them.”

In 1992, when Duckor told Akers of his desire to collect gem Barber halves, Akers responded, “Well, I have 10 of them. Why don’t we start you with them?”

Akers sent him the 10 Barber halves. Duckor had reservations about the price of one, a 1904-S graded MS-67, so he mailed it back to Akers.

“Are you sure?” Akers said in a follow-up call.

“No,’ Duckor responded. “Send it back.”

The doctor purchased the coin for $8,500. In 2010, when his collection of Barber halves was sold at auction, the coin realized $125,000 and was declared the finest known.

Notable Sale

1904-S Barber Half Dollar MS67 PCGS Secure. CAC.

Pedigreed to the James A. Stack Collection

that was sold in 1975, this lovely piece is

one of two Gem examples known, and was offered

as part of the Dr. and Mrs. Steven L. Duckor

Barber Half Dollar Collection sold in August 2010.

Price realized: $138,000

An ability to spot winners ranks Duckor among the greatest living collectors, says Todd Imhof, executive vice president at Heritage Auctions. “In numismatics, only a small percentage of pedigrees continue to deliver a premium price years after a collector sells his coins and the Duckor name is one of those,” Imhof says. “His approach to collecting reflects that of a true connoisseur, and his personality and integrity make him one of my very favorite people to work with.”

Duckor has equal praise for his auction partners. All the coins he has sent to auction in the past two decades have gone to Heritage Auctions. Results, he says, have been “tremendous” and catalog descriptions “detailed and wonderful.” Imhof, he says, has been his exclusive “go-to guy.”

“Todd,” Duckor says, “is one of those guys who is totally on top of his game. I don’t think there is anyone in numismatics today that has a greater understanding of the overall marketplace and of the dynamics that cause a certain area to appreciate or decline. His ability to get deals done that are fair and effective for both sides, no matter how complicated, has been a huge asset for me over the years.”

Duckor believes trustworthy partners, dealers and mentors are important to becoming a successful collector. “You have to find somebody you can trust that is knowledgeable,” he says. “Make sure you feel comfortable, that it’s a comfortable fit.”

He is critical of what he calls “newer dealers” who are not as educated or knowledgeable as Akers or gold coinage expert Doug Winters, with whom he began working after Akers’ death. Some of the newer dealers, he says, rely too much on third-party grading (what’s on the slab) rather than the coin itself. “That’s why I think it’s helpful to have CAC stickers,” Duckor says. “It’s another layer of confirmation of the grades.”

When it’s Time to Move On

Unlike many collectors, Duckor does not feel compelled to amass complete collections nor does he think in terms of keeping his collections for a lifetime. “To me there’s as big a pleasure in selling as there is in buying,” he says. “It reconfirms your thoughts on what you bought. It validates what you have done.

“I know when it’s time to move on. There’s always a time,” he says. “My Saint-Gaudens $20 gold collection that I sold in January 2012 I had for over 30 years. … On the other hand, my $1 gold collection that I started six years ago was sold in August [2015].”

He says his goal when starting his $1 gold collection was to buy only coins grading MS-65 or better, which eliminated a third of the coins in the set because they do not exist in those grades. His collection consisted of 54 coins.

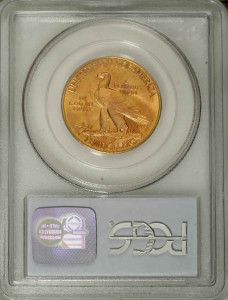

Notable Sale

1920-S Indian Eagle,MS67 PCGS.

An astonishingly beautiful Superb Gem

from the Dr. Steven L. Duckor Collection, this

1920-S Indian Eagle is the finest certified example,

and was offered by Heritage Auctions in March 2007.

Price realized: $1,725,000

Mark Borckardt, senior cataloger and numismatist at Heritage Auctions, describes Duckor’s $1 gold collection as “far finer than any other gold dollar collection ever offered for public sale.” It included four graded MS-64, six MS-65, three MS-65+, eight MS-66, one MS-66+, eight MS-67, six MS-67+, 13 MS-68, and five MS-68+. (All coins were PCGS graded and CAC approved.)

Duckor points out that his collection did have a few coins below the MS-65 threshold. “For instance, Dahlonega. I only collected the 1855-D in MS-64 because it is the finest known. The only Charlotte coin I collected was the 1849-C in MS-64, the finest known.”

His secondary goal when he began his $1 gold collection was to sell it by the time he was 70. “I just turned 70!” Duckor said shortly after the auction.

He says he has always collected coins for fun and pleasure. “It’s a break from medicine for me. It’s actually fun as a diversion from my gastroenterology practice. I have a very busy practice, even at this age. … It gave me a focus, a hobby. I owe a lot to coins, no question about it.”

Duckor’s current collecting focus is Walking Liberty half dollars, a series he describes as “familiar territory” because he collected it 40 years ago. However, he is not collecting the entire series this time. He is collecting the years 1916 to 1933. “That’s because those are the toughest dates. Those are the hardest to find in gem.”

He points out, “The only difference is 40 years ago, the 1919-S was rarer than the 1919-D. Now the D and 21-S are the two rarest dates in the Walker series.”

He continues to collect series because he likes to study in-depth what he is collecting. “As I get older, I don’t need to complete a series. I don’t have a 1919-D Walker in MS-65. I only want it in MS-65 CAC because there’s only one. … I always advise collectors not to fill every hole. If you only get two coins out of 20 in gem, that’s fine. You don’t have to finish a set. That’s what I’ve learned over the years.”

He also advises collectors to be patient.

“Don’t buy with the thought ‘I’ll upgrade.’ Wait until the right coin comes ago. You can go crazy upgrading all the time. Great collections do come on the auction block every few years.”

He looks back at the advent of third-party grading as an important milestone and takes pride in the role his collection played.

“In 1985, I received a call from David Hall,” Duckor remembers. “He asked if he and Gordon Wrubel could look at my 20th century gold collection. He said they had a ‘new idea.’”

Hall and Wrubel met Duckor at his bank to examine the entire collection. “They each graded the coins separately,” Duckor explains. Later they provided him with copies of their grading sheets. He was amazed at how accurately and how close their grades were. He describes that exercise as a “founding experiment,” noting that Hall and Wrubel went on to launch Professional Coin Grading Service in February 1986.

Notable Sale

1863 Gold Dollar MS68 PCGS Secure. CAC.

Offered as part of the Duckor Family Collection of

Gold Dollars in August 2015, this stunning

1863 carries a provenance from famous

Chicago collector Virgil Brand and the late David Akers.

This is the finest-known 1863 gold dollar by two grade points.

Price realized: $193,875

Three years later, PCGS graded and encapsulated his entire 20th century gold collection. Since that time, experts agree that third-party grading has helped propel rare coins into a $5 billion market today.

“PCGS, and shortly thereafter Numismatic Guaranty Corporation, established a solid standard of independent grading that gave coin collectors and investors an unprecedented level of confidence in the numismatic marketplace,” Imhof says. “Endorsements of PCGS by prominent collectors like Dr. Duckor helped transform the rare coin marketplace into a far more vibrant, liquid and credible place to buy and sell.”

Collecting coins today, Duckor says, is much easier than in the past. He credits the vast amount of information available on the Internet – access to auction records, grading service population reports, blogs and the ability to communicate directly via email with other collectors – as bringing important changes to coin collecting.

But he also looks back to the standard references and researchers such as David Akers and David Hall writing in the 1970s and 1980s. He said he was reviewing some of their work recently on Walkers and 20th century gold and noted they were “90 percent accurate on what was rare and what wasn’t rare.” He observed that the old-time researchers were accurate without using pop reports, third-party grading, CAC or other tools readily available today.

“Amazing!” Duckor declares.

BETH DEISHER, retired editor of Coin World, is author of Cash In Your Coins: Selling the Rare Coins You’ve Inherited.