WHETHER YOU COLLECT FINE ART OR BASEBALL CARDS, THIS OVERVIEW WILL HELP YOU CUT THROUGH THE JARGON TO BETTER UNDERSTAND YOUR POLICY’S COVERAGES, TERMS AND LIMITATIONS

By James Appleton

If your homeowner’s insurance bill has increased significantly over the past 18 months, you are not alone. The property insurance market is experiencing turbulence. Premiums are going up, deductibles are increasing, and claims forgiveness is hard to come by. Many of the factors driving these changes are discussed in another Intelligent Collector article (read it here).

For avid collectors who rely on a homeowner’s policy to protect their treasured items, it has never been a better time to seek out alternative insurance solutions. Specialty insurance policies designed to protect your investment in fine art and other collectibles offer a number of benefits that make them a more cost-effective choice for insuring valuable collections.

Collections of decorative art, like this pair of 20th-century Chinese vases that realized $32,500 in a June 2024 Heritage auction, can be covered under a monoline collectibles insurance policy.

Collectibles Insurance in Action

There are key features of most stand-alone (monoline) collectibles insurance policies that make them a more appropriate solution for protecting the financial investment you’ve made in curating and maintaining your treasures. Here is a brief overview of terms you may see in a collectibles insurance policy to help you make an informed choice about your insurance options:

- Unscheduled vs. Scheduled: The term “schedule” refers to an inventory or list. Collectibles insurance policies typically are unscheduled, although some providers may require a list of individual items valued over $25,000 (or other stated value). Homeowner’s policies usually require a schedule of personal property to be covered under the policy.

- Appraisals: Standard homeowner’s policies require that appraisals be submitted along with the property schedule. Collectibles policies are usually “onus of proof” and require an appraisal only when you submit a claim.

- Valuation: A hallmark of specialty collectibles insurance is that the concept of appreciation in value is built into the policy. Items are insured for their full collectible (appreciated) value. Under a homeowner’s policy, personal items are insured for actual cash (depreciated) value, which is usually substantially less than collectible value.

- Limits and Sub-Limits: The policy limit is the maximum amount available to pay for a covered claim, and a sub-limit is the maximum amount (lower than the limit) that will be paid for a certain type of covered claim – water damage, for example. Collectibles insurance allows you to choose a policy limit, typically up to $1 million, and does not impose sub-limits. Homeowner’s policies generally determine the limit for personal items and often impose sub-limits.

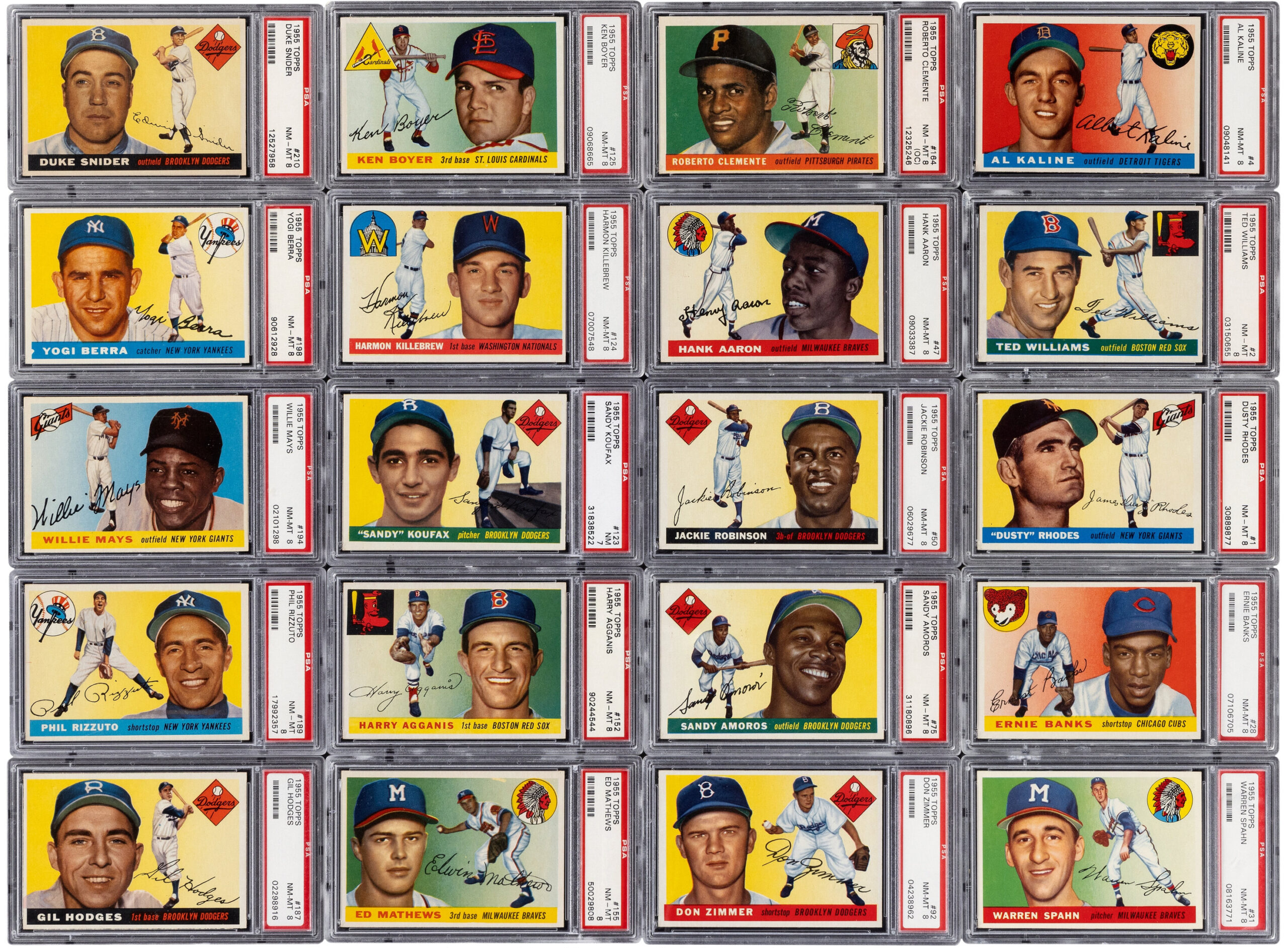

Collecting sports cards, like this PSA-graded 1955 Topps Baseball complete set that sold for $111,000 in an October 2024 Heritage auction, can be a costly endeavor. The right insurance policy can help protect your investment.

- Water Damage: Coverage for water damage is usually included in both specialty collectibles policies and homeowner’s insurance. If you have a significant financial investment in your collection, the key thing to understand is that water damage and flood damage are two separate perils. Coverage for water damage does not equal coverage for flood damage. The primary difference between these two perils is the source of the water. Water damage coverage applies to sudden and accidental events such as a broken pipe, overflowing sink or rainwater that comes through a roof damaged by wind during a storm. Flood damage results from rising water, often from a natural water source, that inundates an area of land that is typically dry. Except in rare instances, flood insurance must be purchased separately from other insurance policies.

- Accidental Breakage: Coverage for accidental or unexpected damage to an item of property is typically included in a specialty policy for fine art and collectibles. This coverage may be available through a homeowner’s policy as an optional coverage and would increase the policy premium.

- Loss in Transit: Loss in transit is coverage for your insured collection or item that is damaged or lost while moving from one location to another. Typically included in a collectibles insurance policy, this coverage provides peace of mind when you need to move your collection between homes, transport pieces to a collector event or art show, or move items into a self-storage or art storage facility. In most cases this coverage is not included in standard homeowner’s policies but may be available for an additional premium.

- Mysterious Disappearance: Most collectibles insurance policies include coverage for mysterious disappearance. If the loss of a covered collection or individual item can’t be explained by other perils or for which you have no evidence of when, how or why the item disappeared, it may be covered under this coverage. Homeowner’s policies generally do not offer coverage for mysterious disappearance.

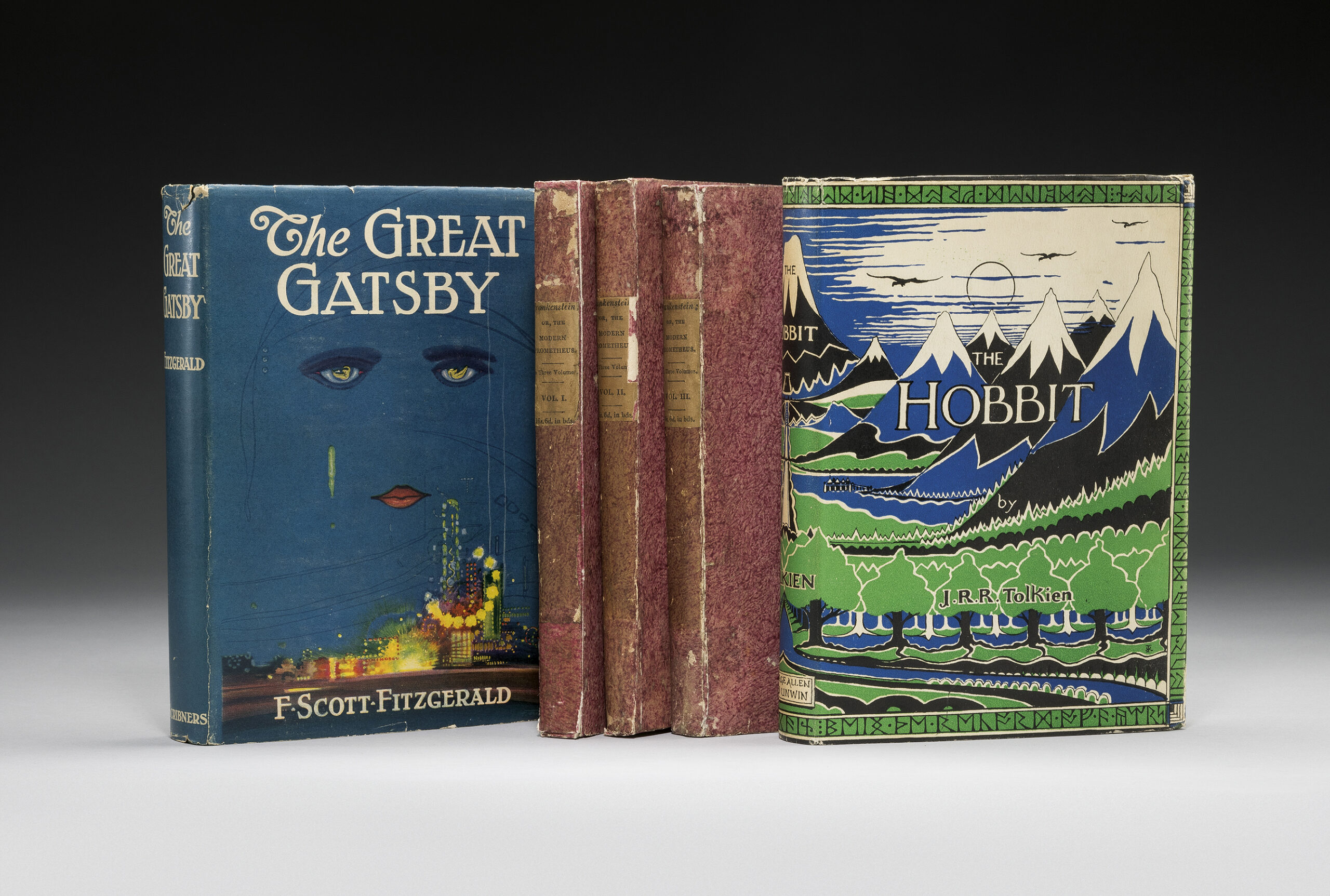

Rare books are another collectible category that can be covered under a stand-alone insurance policy. This collection belonged to North Dakota collector William A. Strutz, who built one of the finest private libraries in America.

Working With Your Insurance Agent

Your best resource when it comes to insuring your collection is your trusted insurance agent. They can work with you to identify the most appropriate coverage for your valuable items, including fine art, sports memorabilia, rare books, antique furnishings and other collectibles. Reach out to request a coverage review, and together you can identify the insurance solution that fits your budget and provides peace of mind.

JAMES APPLETON is Director of Program Sales for Phoenix-based MiniCo Insurance, a Jencap company. MiniCo offers monoline specialty insurance specifically designed to cover fine art, collectibles and items expected to increase in value. Additional information is available at MiniCoCollectiblesDirect.com.